Tools and Techniques for Determining the Value of Any Asset: University Edition

In the ever-evolving financial landscape, the ability to accurately determine the value of assets is crucial for investors, financial analysts, and business professionals alike. Whether you're evaluating an investment opportunity, assessing the worth of a company, or simply making informed financial decisions, a comprehensive understanding of asset valuation tools and techniques is indispensable.

4.6 out of 5

| Language | : | English |

| File size | : | 26966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1685 pages |

| Lending | : | Enabled |

| Paperback | : | 78 pages |

| Item Weight | : | 7.4 ounces |

| Dimensions | : | 8.5 x 0.19 x 8.5 inches |

This article serves as a comprehensive guide to the world of asset valuation, providing an in-depth analysis of the various approaches, methodologies, and factors that influence the valuation process. From the widely used discounted cash flow analysis to the intricacies of comparable company analysis, you will gain a thorough understanding of the techniques employed by professionals to determine the true value of assets.

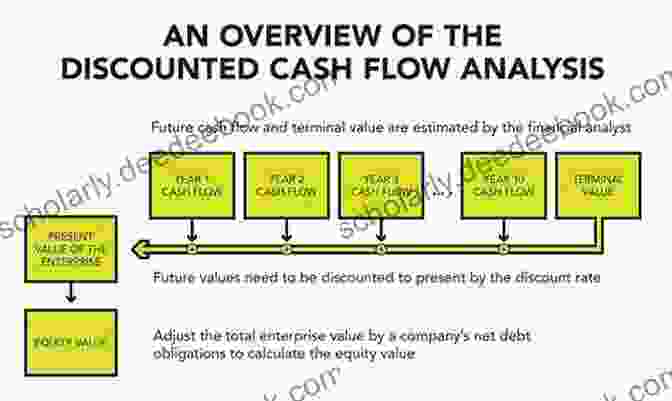

Discounted Cash Flow Analysis (DCF)

Discounted cash flow analysis (DCF) is a widely recognized and fundamental technique used to determine the present value of future cash flows. It involves projecting future cash inflows and outflows associated with an asset or investment, and then discounting these cash flows back to the present using a predetermined discount rate.

DCF provides a sound foundation for evaluating long-term investments, such as real estate, infrastructure projects, or business ventures. By incorporating factors such as inflation, growth potential, and risk, DCF enables analysts to assess the intrinsic value of an asset and make informed investment decisions.

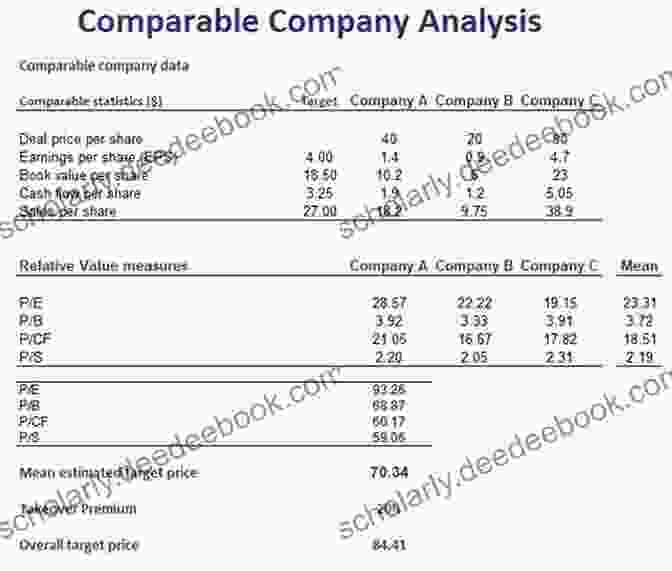

Comparable Company Analysis (CCA)

Comparable company analysis (CCA) is a relative valuation technique that involves comparing a target company to a group of similar companies, known as comparables. The comparables are selected based on industry, size, operating characteristics, and financial performance.

CCA is commonly used in evaluating publicly traded companies. By analyzing financial ratios, multiples, and other relevant metrics, analysts can derive a range of potential values for the target company. This approach provides valuable insights into the market's perception of similar businesses and helps investors make informed investment decisions.

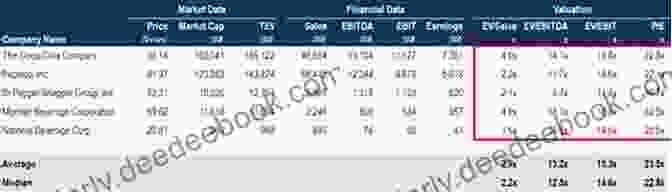

Market Multiple Analysis (MMA)

Market multiple analysis (MMA) is a valuation technique that utilizes multiples derived from the market prices of comparable companies. These multiples can include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, or price-to-book (P/B) ratio.

MMA involves multiplying the target company's financial metrics, such as earnings, sales, or book value, by the appropriate market multiple. This approach provides a quick and relatively straightforward method for valuing companies. However, it relies heavily on the accuracy and comparability of the selected multiples.

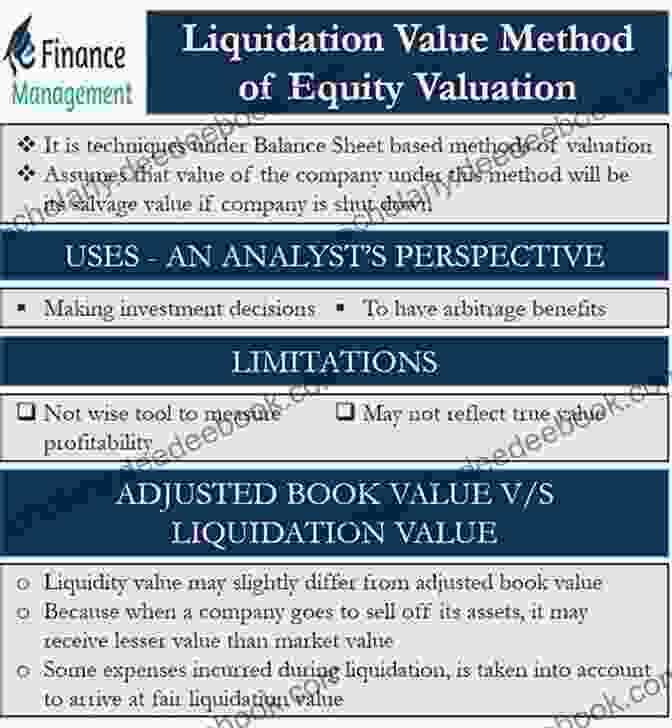

Liquidation Value

Liquidation value represents the estimated amount of cash that could be generated by selling off the assets of a company in a forced sale scenario. It is often used to determine the minimum value of a company in the event of a bankruptcy or other distress situation.

Liquidation value is typically calculated by summing up the estimated market value of all the company's assets, including inventory, equipment, real estate, and intangible assets. It is important to note that liquidation value may differ significantly from the company's going-concern value, which reflects the value of the company as an ongoing business.

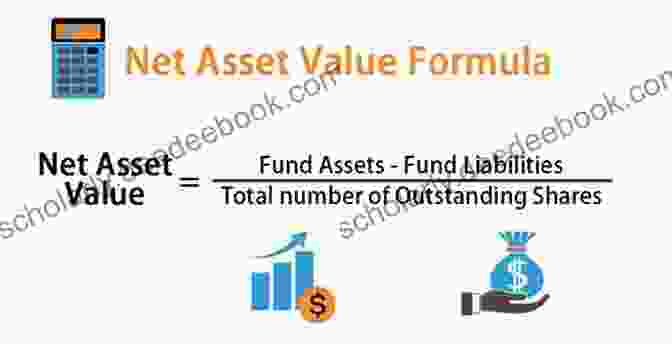

Net Asset Value (NAV)

Net asset value (NAV) is a measure of the value of a company's assets minus its liabilities. It is commonly used to evaluate closed-end funds, such as mutual funds or exchange-traded funds (ETFs),which do not trade at their net asset value.

NAV is calculated by dividing the fund's total assets by the number of outstanding shares. It provides investors with an estimate of the intrinsic value of the fund's holdings. However, it is important to note that NAV can fluctuate based on changes in the market value of the underlying assets.

Factors Influencing Asset Valuation

In addition to the specific tools and techniques discussed, numerous factors can influence the valuation of any asset. These factors include, but are not limited to:

- Industry and Economic Conditions: The overall health of the industry and the broader economy can significantly impact asset values.

- Company-Specific Factors: The financial health, competitive advantages, and management team of a company can affect its valuation.

- Market Sentiment: Investor sentiment and market expectations can influence asset prices, leading to fluctuations in valuation.

- Interest Rates: Changes in interest rates can impact the discount rates used in DCF analysis and the value of fixed-income assets.

- Inflation: Inflation can affect the future value of cash flows and the overall purchasing power of assets.

Comprehending the tools and techniques for determining the value of any asset is essential for informed investment decision-making. By mastering the principles of discounted cash flow analysis, comparable company analysis, market multiple analysis, liquidation value, and net asset value, you will gain the knowledge and skills to navigate the complex world of asset valuation.

Remember that asset valuation is not an exact science, and there can be multiple approaches to determining the value of an asset. The most appropriate method will depend on the specific circumstances and the purpose of the valuation. By considering the factors that influence asset valuation and utilizing a combination of techniques, you can enhance your ability to make sound investment decisions and accurately assess the worth of any asset.

4.6 out of 5

| Language | : | English |

| File size | : | 26966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1685 pages |

| Lending | : | Enabled |

| Paperback | : | 78 pages |

| Item Weight | : | 7.4 ounces |

| Dimensions | : | 8.5 x 0.19 x 8.5 inches |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Novel

Novel Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Shelf

Shelf Foreword

Foreword Synopsis

Synopsis Annotation

Annotation Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Reference

Reference Encyclopedia

Encyclopedia Dictionary

Dictionary Thesaurus

Thesaurus Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Periodicals

Periodicals Research

Research Reserve

Reserve Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Dissertation

Dissertation Awards

Awards Book Club

Book Club Theory

Theory Textbooks

Textbooks Matteo Rampin

Matteo Rampin Victoria W Wolcott

Victoria W Wolcott Hailey Smoke

Hailey Smoke Russell Dunn

Russell Dunn Sarah Dunn

Sarah Dunn Giovanni Mari

Giovanni Mari John Anghelache

John Anghelache Jacinta Cremades

Jacinta Cremades Ann Larabee

Ann Larabee Reta Maclennan

Reta Maclennan Terry Kaye

Terry Kaye Marc Morrone

Marc Morrone Alan Siaroff

Alan Siaroff Chan

Chan Susan Sallis

Susan Sallis Michael Ferrari

Michael Ferrari Michael Ryan

Michael Ryan Robert Beaumont

Robert Beaumont Kathy Duval

Kathy Duval Lee Robinson

Lee Robinson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Thomas PynchonCorporatization and the Right to Water in Colombia: A Struggle for Water...

Thomas PynchonCorporatization and the Right to Water in Colombia: A Struggle for Water... E.E. CummingsFollow ·8.4k

E.E. CummingsFollow ·8.4k Jessie CoxFollow ·2.8k

Jessie CoxFollow ·2.8k Neil GaimanFollow ·5.4k

Neil GaimanFollow ·5.4k Houston PowellFollow ·13.8k

Houston PowellFollow ·13.8k Dion ReedFollow ·12.3k

Dion ReedFollow ·12.3k Cooper BellFollow ·3.7k

Cooper BellFollow ·3.7k Duane KellyFollow ·9.5k

Duane KellyFollow ·9.5k Gene PowellFollow ·13.2k

Gene PowellFollow ·13.2k

Houston Powell

Houston PowellMusorgsky and His Circle: A Russian Musical Revolution

Modest Mussorgsky was a Russian...

Barry Bryant

Barry BryantRanking the 80s with Bill Carroll: A Nostalgic Journey...

Prepare to embark on a captivating...

Kelly Blair

Kelly BlairThe Diplomat's Travel Guide to Festivals, Holidays, and...

India is a land of vibrant culture and...

José Saramago

José SaramagoFancy Nancy Nancy Clancy: Late-Breaking News!

Nancy Clancy is back with all-new adventures...

Trevor Bell

Trevor BellGestalt Psychotherapy and Coaching for Relationships: A...

Relationships...

Federico García Lorca

Federico García LorcaThe Last Love of George Sand: An Enduring Legacy of...

At the twilight of her remarkable life,...

4.6 out of 5

| Language | : | English |

| File size | : | 26966 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1685 pages |

| Lending | : | Enabled |

| Paperback | : | 78 pages |

| Item Weight | : | 7.4 ounces |

| Dimensions | : | 8.5 x 0.19 x 8.5 inches |